Your Money, Your Update

A Quarterly Review of Investment Trends and Strategy From Our Investment Committee

Quarter 1, 2025

Join Sayer Martin, CFA, and John Burke, as they discuss major market happenings heading into the second quarter of 2025, including AI, inflation, stocks & bonds, and the current market. Yes, they get into all of it! They also offer perspective on international markets and what else is to come in 2025.

*Filmed on April 4, 2025

The first quarter of 2025 proved that even a strong bull market can take a breather. After two years of exceptional gains, we saw a bit of turbulence in Q1 – including a bona fide S&P 500 correction – but also some bright spots internationally and in other asset classes. In this update, we’ll review what happened across markets and how our diversified approach helped navigate the volatility. We’ll touch on everything from the “Magnificent 7” mega-cap stocks and AI optimism to tariffs, interest rates, and the importance of staying diversified. Let’s dive in.

Looking for additional commentary on tariffs? Check out our video: https://youtu.be/JJ6Ho2atahE

*This episode may contain non-client uncompensated endorsements.

Q1 2025 Market Performance Overview

Despite a roller-coaster quarter, global equities managed to hold their ground overall, with U.S. stocks dipping and international markets leading. Here’s a quick snapshot of year-to-date performance (as of March 31, 2025):

- S&P 500 Index: -4.3% YTD (after a mid-quarter pullback of roughly 10%)

- MSCI EAFE Index: +6.9% YTD (helped by strong rebounds in European markets)

- Bloomberg U.S. Aggregate Bond Index: +2.8% YTD (higher bond prices as yields eased)

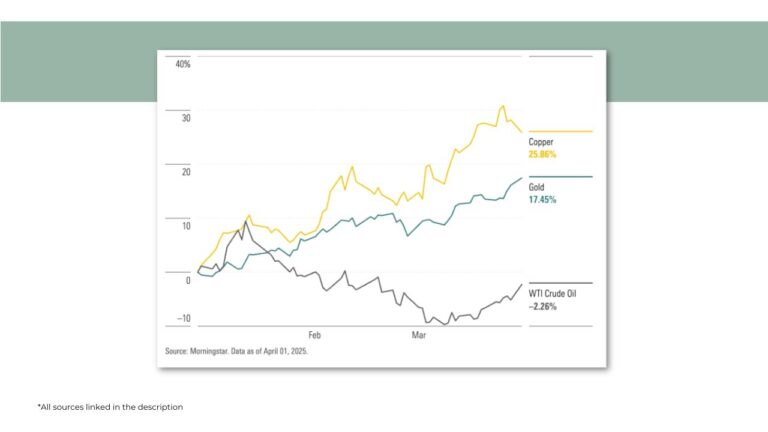

- Gold: +17.4% YTD (benefiting from “safe haven” demand amid uncertainty)

The U.S. stock market hit some air pockets: by mid-March the S&P 500 officially entered correction territory (a >10% drop from recent highs) before bouncing back briefly and ultimately ending the quarter lower. Meanwhile, international stocks stole the show. European equity indices climbed to multi-year highs, and Chinese stocks staged a stunning rally – Hong Kong’s Hang Seng Index surged 15.3% in Q1. Such divergence has been unusual in recent years but underscores the value of global diversification.

It was also a quarter full of headlines. A new U.S. administration took office and wasted no time shaking up trade policy with sweeping new tariffs on major trading partners. At the same time, the Federal Reserve hit the “pause” button on interest rate changes, monitoring how these trade moves and other factors might impact the economy. And in the tech world, a Chinese AI upstart named DeepSeek burst onto the scene with a breakthrough that forced investors to rethink the entire AI investment boom. We’ll discuss each of these in context below, and how they impacted different asset classes.

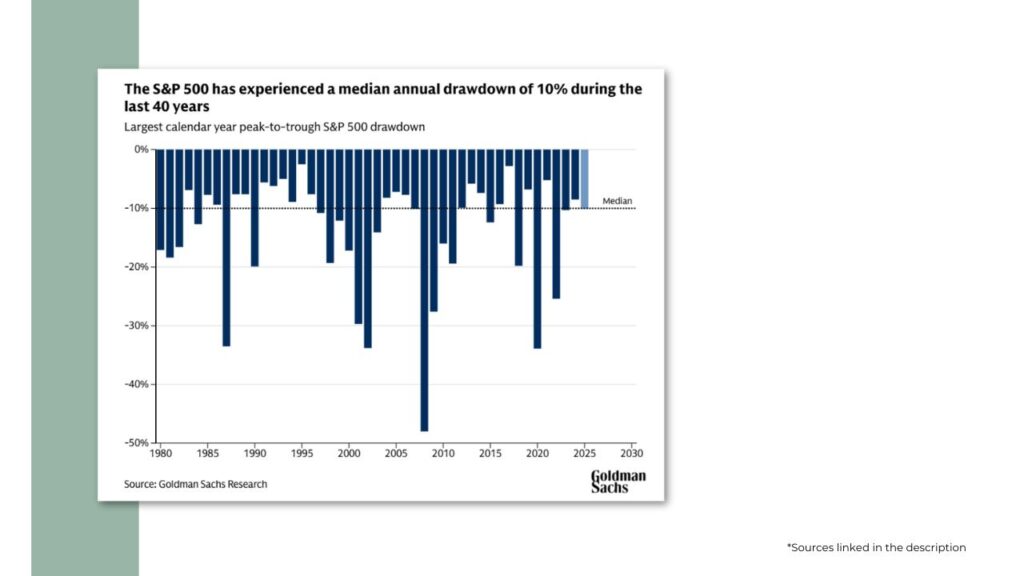

Before we break down performance by asset class, it’s worth remembering that periods of volatility – even corrections – are normal. As long-term investors, we view these episodes as opportunities to rebalance and reaffirm our strategies. Now, let’s examine Q1’s events in more detail, starting with equities.

Equities: U.S. Volatility, International Strength, and an AI Reality Check

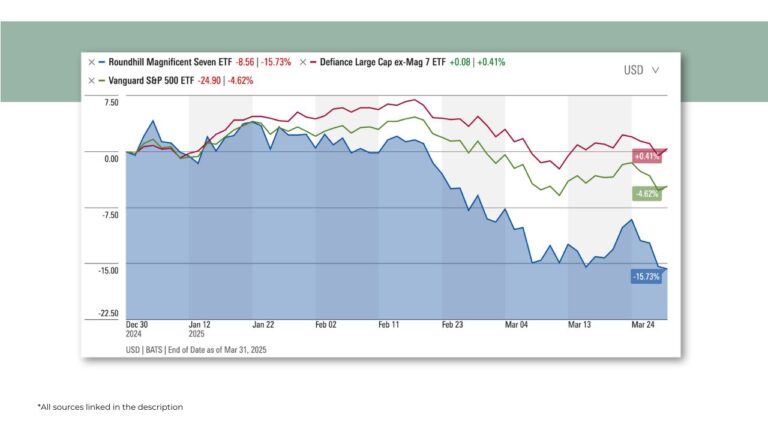

After a blockbuster 2024, U.S. equities hit some turbulence. The S&P 500 slipped into a “correction” – off 10% or more – in early Q1 amid profit-taking and policy uncertainty. Notably, the market’s “Magnificent Seven” mega-cap tech stocks – Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Meta, and Tesla – which had powered much of last year’s gains, stumbled hard this quarter. By the end of Q1, not one of these seven stocks was positive for the year. In fact, five of the seven were down between 10% and 20% year-to-date, while Tesla plunged almost 36%. This is a stark reversal from 2024, when these giants accounted for nearly 40% of the S&P 500’s total gains.

What caused the stumble in U.S. mega-cap tech? Part of it was simply valuation and expectations catching up – after huge 2023-24 runups, even great companies need to “grow into” their stock prices. But we also got a wake-up call from overseas: DeepSeek. In late January, this relatively unknown AI startup from Hangzhou unveiled a new AI model (DeepSeek-R1) that nearly matched OpenAI’s ChatGPT in capability – but at a tiny fraction of the cost. Reportedly it spent only about $6 million on training, versus the billions that U.S. tech giants pour into AI to get similar results.

The news spooked AI investors, triggering a one-day $600 billion selloff in AI-related stocks (led by Nvidia) and prompting hard questions about the assumed dominance (and high valuations) of U.S. chipmakers. In short, DeepSeek proved that the AI race is far from a U.S.-only game – and that smart engineering can dramatically cut costs. This doesn’t make our big tech companies any less innovative, but it does remind investors that today’s AI optimism must be balanced with realism about competition and the pace of advancement. The episode contributed to volatility in tech shares and is likely one reason the AI hype trade took a breather in Q1.

Given the prevailing crosscurrents, it’s not surprising U.S. equities saw more volatility this quarter. The S&P 500’s intraday swings were larger than we’ve been used to recently, and the index ended the quarter lower. The good news is that the broader market showed resilience. In January and February, while the mega-caps sagged, the equal-weighted S&P (which treats Apple the same as a smaller stock) actually performed quite well, indicating strength in the “other 493” names.

The above chart shows the Vanguard S&P 500 Index (green) versus the Roundhill Magnificent Seven ETF (blue) and the other 493 stocks (Defiance Large Cap ex-Mag 7 ETF, green) for the first quarter of 2025. While the “Mag 7” (blue) was down 15.7%, the rest of the index (red) was up slightly (0.4%), keeping the overall S&P 500 (green) to less than one-third of the Mag 7’s losses. This indicates that diversification within equities – not just owning the popular tech giants – has been key to weathering the market’s ups and downs.

On top of that, policy uncertainty weighed on sentiment. The new administration’s aggressive tariff announcements – aiming import taxes of 10-25% at China, Mexico, and Canada – created unease for multinationals and raised concerns about rising costs. By March, mentions of tariffs on corporate earnings calls had gone “parabolic,” even approaching the levels seen during the 2018 U.S.-China trade war. Companies from industrial exporters to retailers are assessing how the new trade barriers might impact supply chains and input prices. This contributed to some knee-jerk selling, especially in sectors like manufacturing and technology hardware that rely on global trade. The risk of a broader trade war introduced a new variable for markets to digest.

If U.S. equities took a pit stop, international markets revved their engines. Non-U.S. equities outperformed notably in Q1, boosted by cheaper valuations and some region-specific catalysts. European stocks extended their recent upswing – in fact, Europe’s STOXX 600 index hit all-time highs during the quarter. A combination of factors fueled this: bargain valuations (Europe was trading at a deep discount to the U.S.), investor re-positioning (global funds increasing exposure after years of underweighting Europe), and even some pro-growth policies. For example, Germany unveiled fiscal stimulus plans and European Union (EU) leaders talked up deregulation efforts to spur competitiveness. These moves, along with easing energy prices, have improved the outlook for European corporate earnings. As a result, major European markets handily beat a lower U.S. market.

It wasn’t all rosy – Europe faces its own challenges, including slower growth and the threat of those U.S. trade tariffs (which, if they escalate, could bite European exporters too). But so far in 2025, European equity strength has been a positive surprise. It’s a reminder that last year’s laggards can become this year’s leaders. We have maintained a strategic allocation to developed and emerging markets (EM) international stocks in client portfolios, and that paid off in Q1.

Another star of Q1 was China – a market that had been left for dead by many investors in recent years. Chinese equities roared back to life early in 2025, putting them near the top of the global leaderboard. This surge came as China’s tech sector and stimulus efforts finally showed signs of traction. After a prolonged slump, Chinese authorities rolled out measures to boost consumer spending and property markets, and investor sentiment towards China flipped from extreme pessimism to cautious optimism. Importantly, China’s strides in technology (like the DeepSeek moment) signaled that its companies might close the gap in the AI race. That narrative – “China as an AI contender” – contributed to a rally in Chinese tech shares, providing a counterweight to declines in U.S. tech. Our EM allocation contributed positively this quarter for the first time in a while, which reinforces why we maintain exposure even when headlines are bearish. In investing, things can turn when least expected.

Given the crosswinds – from Fed policy to tariffs to tech surprises – a pickup in volatility was not shocking. It’s worth putting the S&P 500’s Q1 correction into context. The index had nearly doubled over the 5 years through year-end 2024. A pause or pullback was inevitable. In fact, historically the S&P 500 sees an average intra-year drawdown of around 14%, even in years that finish positive. So this quarter’s 10% dip, while nerve-wracking day-to-day, is not unusual (see chart below). Our Flex portfolios went to cash for several days in mid-March, reducing market exposure until volatility cooled. Our message to clients remains: short-term drops are the price of admission for longer-term gains. By staying diversified and avoiding panic moves, our portfolios remained on track.

Speaking of diversification, Q1 was a case study in its benefits. When U.S. large-cap stocks zigged, other areas zagged. This is exactly why we spread investments across geographies and styles. No one can reliably predict which segment will outperform in a given quarter or year – but a well-balanced portfolio increases the odds that something in your mix is doing well at any given time. And can help smooth the ride on the way to meeting long-term financial goals.

Fixed Income: Steady Yields, Fed on Hold, and Bonds Back in the Game

Bond markets in Q1 were a source of relative calm – even a bit of comfort – amid equity volatility. After an intense year of interest rate hikes in 2023, the Federal Reserve hit pause on rate changes in early 2025, and bond investors breathed a sigh of relief. The Fed had cut its benchmark rate by a full percentage point last year, and in the March 2025 meeting it held rates steady at 4.25-4.50%. Fed Chair Jerome Powell emphasized that the central bank is in “wait and see” mode now, carefully monitoring the fallout from new tariffs and other economic trends. With unemployment still low (~4.1%) but risks of slower growth rising, the Fed signaled it’s prepared to act as needed – balancing between fighting any new inflation pressures from tariffs and supporting growth if business confidence dips. In plain English, the Fed is on hold for now, with a bias toward flexibility.

Bond yields were relatively stable as a result. The 10-year U.S. Treasury yield ended the quarter around 4.2%, roughly where it began the year, after oscillating in a tight range. Short-term yields (2-year Treasury ~4.0%) actually dipped below the 10-year by quarter-end, un-inverting the yield curve slightly. This reflects the bond market’s view that the Fed may have finished tightening – and might even cut later in 2025 if economic growth slows. Notably, Powell acknowledged that the tariff shock is an “exogenous” factor that could raise consumer prices in the short run. The Fed will be watching closely to see if these import taxes start feeding through to persistent inflation. For now, longer-run inflation expectations haven’t spiked.

On the credit side, corporate bonds held up well. Investment-grade bonds benefited from the stable Treasury yields and saw modest spread tightening. High-yield (junk) bonds were more mixed – there was some widening of spreads when stocks sold off in February, but the moves were small. Companies are generally entering this potential slower patch in decent shape, and default rates remain low. We continue to favor the higher-quality segments of fixed income, given all the uncertainty and tight spreads. It’s comforting that yields today are substantially higher than a few years ago – meaning bonds finally offer “income” again. As noted, the U.S. Aggregate Bond index delivered a nearly 3% return in the first quarter, a far cry from the losses of 2022. Core bonds provided a ballast exactly when we needed it: during the stock market’s slide, prices rose slightly, cushioning portfolios. After years where bonds and stocks sometimes fell together (think 2022), it’s a relief to see the traditional inverse relationship reassert itself.

In terms of our strategy, we maintained a neutral duration posture (not making big bets on rates rising or falling) and that served us well. The income from our bond holdings – now with yields of 4-5% – is doing the heavy lifting, and any price appreciation is a bonus.

Overall, fixed income is back as an important contributor to portfolios. It’s been a long time since we could say that. After years of near-zero yields, today’s bond market actually offers a meaningful alternative to equities and a buffer against volatility. As 2025 unfolds, we expect bonds to continue playing a crucial stabilizing role, especially if economic growth shows more signs of cooling.

Beyond Stocks and Bonds

Our allocation to other asset classes also provided additional support this quarter, reinforcing the old adage that “diversification is the only free lunch” in investing. Several non-traditional asset classes delivered positive returns and low correlation to stocks just when we needed them.

Gold was the standout. The shiny metal lived up to its reputation as a safe-haven asset, rallying another 17% in the first three months of 2025, even after strong gains in 2024. In fact, gold hit all-time highs (in many currencies) during Q1 amid the equity volatility and trade war jitters. Why such a surge? A few reasons: real interest rates remain relatively low (making gold more attractive versus interest-bearing assets), the U.S. dollar weakened slightly (down 4%), and investors sought protection against a list of worries – tariffs (there’s that word again) potentially boosting inflation, geopolitical tensions, and even those tech sector wobbles. Gold’s strong performance was a boon to portfolios that held even a small slice. We keep a modest allocation to gold as a hedge in some portfolios, and in Q1 that hedge paid off.

Copper was another standout commodity, rising nearly 26%, while oil fell slightly. On the other end of the spectrum, bitcoin dropped 13%, taking a breath following a stellar performance in 2024.

Closing Thoughts and Looking Ahead

Sources

We head into Q2 2025 with a cautious but constructive outlook. The volatility we saw in the first quarter – from the S&P 500’s swings to oil’s dip – reminds us that the market is adjusting to a new regime: higher interest rates than we had a couple years ago, active geopolitics (trade policy U-turns, war concerns), and rapid innovation that can both create and disrupt value (as DeepSeek showed in AI). Our job, as always, is to synthesize these moving parts into a coherent investment strategy for you, our clients.

A few key themes we’re watching as the year progresses:

- Federal Reserve and Interest Rates: Will the Fed hold steady, hike (if inflation flares from tariffs), or cut (if growth decelerates sharply)? Right now, they’re signaling patience. We expect no major change in the next meeting or two. If anything, market turmoil could keep the Fed on hold longer, which would be supportive for both stocks and bonds. We have positioned fixed income to benefit from the current yield levels and any eventual rate cuts, while being mindful of inflation risks and credit spreads.

- Earnings and the Economy: Corporate earnings for Q1 will start rolling in soon, and they’ll give insight into how companies are coping with higher costs and tariffs. We anticipate earnings growth to be modest this year after the big post-pandemic gains. The U.S. economy is sending mixed signals – consumer spending is OK, but consumer sentiment is softening, and the Atlanta Fed’s GDPNow tracker even dipped slightly negative for Q1. A mild slowdown wouldn’t surprise us.

- Trade Policy Wildcard: The tariff volleys in Q1 were an opening act to a reciprocal tariff policy announced on April 2nd, which includes a baseline tariff of 10% on various imports, plus additional reciprocal tariffs amounting to roughly half the rates charged by trading partners. This is a fluid situation – negotiations could ease tensions, or we could see further escalation. Supply chain reorientation is one likely outcome (companies shifting sourcing to other countries to dodge tariffs), which could benefit certain emerging markets, and some of our U.S. holdings could see increased domestic manufacturing as businesses consider reshoring. There will also be negative impacts. As we go to print, this has created further concern of an economic slowdown as companies and markets transition to this new reality in trade. We’re monitoring developments closely.

- The Tech Landscape and AI: We remain believers in the long-term transformative power of technology and AI. The valuation setback for the Magnificent 7 in Q1 doesn’t change the fact that these companies are innovating furiously (indeed, they collectively account for a huge share of R&D and capex in the S&P 500). However, the market may take a “show me” attitude in the near term – meaning stock prices will depend on delivering actual earnings and cash flow growth, not just hype, from these heavy investments. That’s healthy. We’ll be watching how the big tech firms incorporate AI efficiently (and how upstarts like DeepSeek impact their moats). It’s all about price and expectation.

- Global Opportunities: One quarter doesn’t make a year, but the strong Q1 showing for Europe and emerging Asia could be the start of a more extended period of non-U.S. leadership. Valuations and earnings yield favor international markets right now, and capital is finally starting to flow their way. We are encouraged by signs of life in Europe and EM and are maintaining our positions there. At the same time, if U.S. markets resume leadership, we remain heavily invested there as well. Forward return expectations for equities remain attractive.

In summary, Q1 2025 was a testament to the importance of diversification and discipline. While headlines blared about stock market corrections and new tariffs, a well-balanced portfolio quietly did its job – generating solid, if unspectacular, returns with less volatility.

We expect markets to remain choppy at times – that’s normal in the late stage of economic cycles and in transition periods for policy. But choppiness also creates opportunities for those prepared. We will stay vigilant, ready to adjust tactical tilts as conditions evolve, but always rooted in the long-term plan that fits your goals.

Thank you, as always, for your trust and patience. If you have any questions about recent market moves or how your portfolio is positioned, please do not hesitate to reach out to us.

Have you tuned in to our weekly video podcast, Blue Collar Wealth Presented by Stone House®?

Previous Video Market Updates

*These videos reflect the trends and worldly events taking place at the time of filming.*

Quarter 4, 2024

Quarter 3, 2024

Quarter 2, 2024

Quarter 1, 2024

Quarter 4, 2023

Quarter 3, 2023

Quarter 2, 2023

Quarter 4, 2022

Quarter 3, 2022

Quarter 2, 2022

Quarter 1, 2022

Quarter 4, 2021

Quarter 3, 2021

Meet the Stone House Team

Decades of combined experience in helping people enjoy retirement and reach financial freedom.

Robert J. Brown, CFP®

Partner

Raymond "Scott" Stone

Partner

John Burke

Partner

Kirk Lunger

Partner

Sayer Martin, CFA

Chief Investment Officer

Christine Slusark

Financial Paraplanner

Sherri Roberts

Financial Paraplanner

Barbara Grimaud, Esq.

Senior Advisor

Chad Taake, CFP®

Senior Advisor

Ben Robinson

Lead Advisor

Ryan Vassil, WMS℠

Lead Advisor

Mike Cravath, WMS℠

Lead Advisor

Larry Alderson, CFP®

Senior Advisor

Jennifer Schultz

Client Relationship Manager

Lori Brown

Client Relationship Manager

Katie Johnston

Lead Advisor

Stacey Valent

Office Manager

Lindsey Chiarelli

Director of Marketing & Operations

Anna Layaou

Marketing Content Manager

Leanne Kulah

Senior Client Service Specialist