Your Money, Your Update

A Quarterly Review of Investment Trends and Strategy From Our Investment Committee

Quarter 4, 2024

Join Sayer Martin, CFA, and John Burke, as they discuss major market happenings heading into the first quarter of 2025, including the S&P 500, Presidential Election, Inflation, Bitcoin, and the Federal Fund Rate. Yes, they get into all of it! They also offer perspective on international markets and what’s to come in 2025.

*Filmed on January 6, 2025

Q4 Update

The fourth quarter of 2024 brought several significant developments in financial markets and the global economy, offering both challenges and opportunities for investors. Against the backdrop of another banner period for U.S. stocks, we’ll reflect on the past quarter and full year 2024 as we prepare for the year ahead.

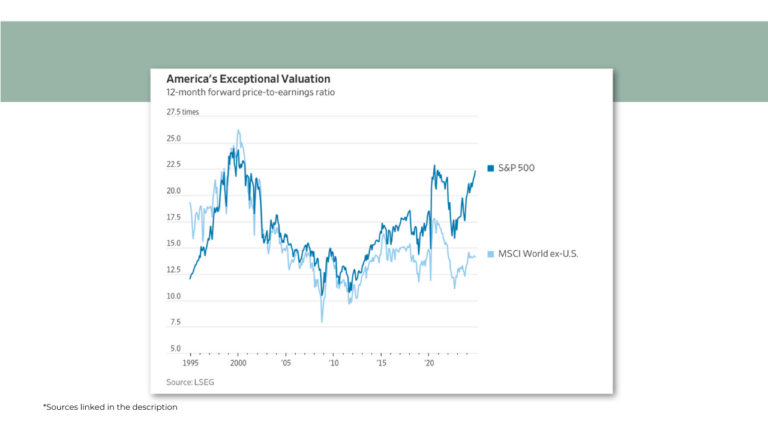

S&P 500 Index

U.S. equities were full speed ahead for the second year in a row, with the S&P 500 Index rising 25%. A particularly heady year, 2024 ranks 22nd among the highest-returning years for the S&P 500 since 1928. Needless the say, the past five years have seen very strong returns, with the S&P 500 Index almost doubling over this period (up 97%) for an annualized return of 14.5%. We’ve enjoyed the ride, but caution investors to view this level of returns as unsustainable, especially considering that multiple expansion – not earnings growth – accounted for more than half of the S&P 500’s returns for 2024.

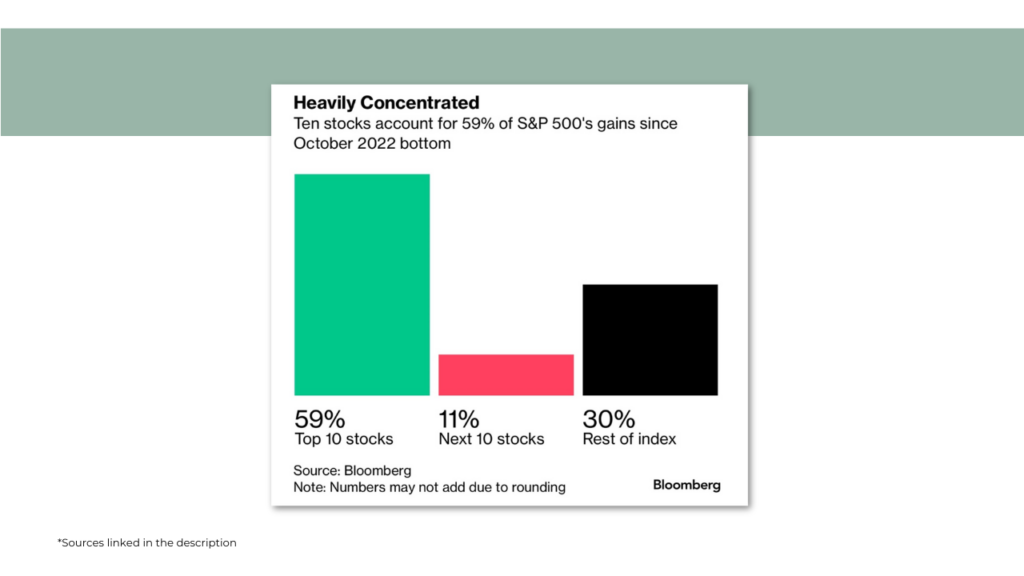

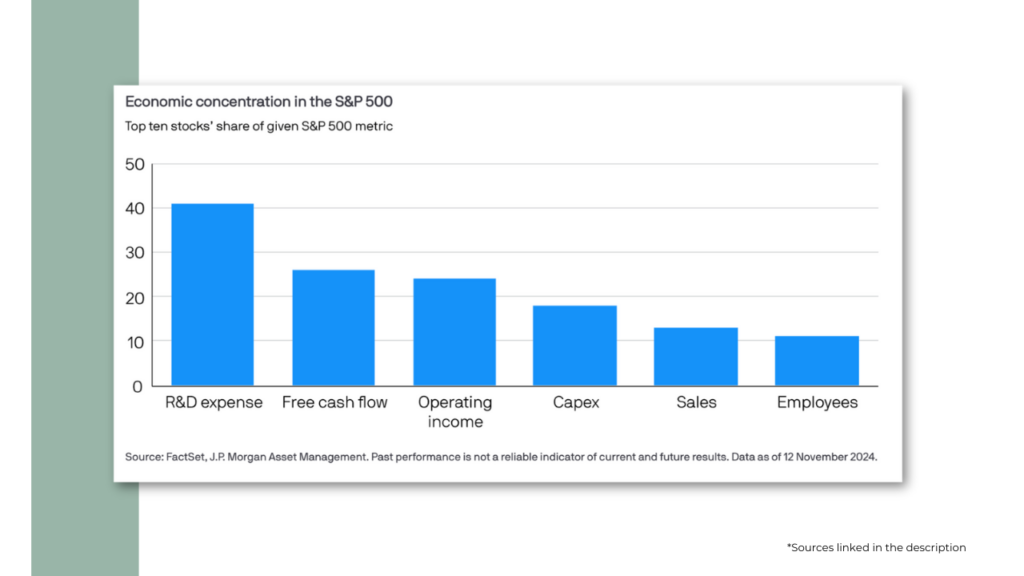

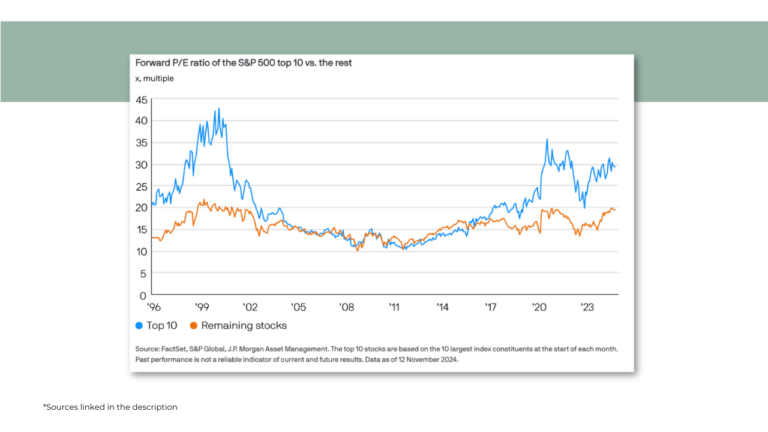

The so-called “Magnificent Seven” stocks – Apple, Microsoft, Alphabet (Google), Amazon.com, Nvidia, Meta Platforms and Tesla – led S&P 500 returns once again this year, accounting for nearly 40% of the total gains. (The top 10 stocks have accounted for 59% of S&P 500 gains since the October 2022 bottom.) These companies reinforced their position as market leaders and remained in the spotlight for the transformative potential of AI-driven innovation across industries. They’re also responsible for a significant portion of the S&P 500’s recent earnings growth and capital expenditures. According to Goldman Sachs, AI-related investments are projected to approach $1 trillion in coming years. Earnings of the future come from the investments of today, so we’ll be closely watching the results from these heavy capital expenditures.

Stock Market

Large-caps were the standout performers, as U.S. mid-cap and small-cap stocks rose a respectable, but comparably smaller 12.2% and 6.8%, respectively. Developed market equities (MSCI EAFE) rose a mere 4.2% for the year, while Brazil (-30.3%), Mexico (-26.4%), and South Korea (-19.6%), were notable decliners. After strong recent equity performance, the United States, which accounts for roughly one-quarter of global Gross Domestic Product (GDP), now represents about 70% of global equity market capitalization. International markets finished the year with the largest valuation gap to U.S. stocks in three decades. This disparity raises questions about valuation gaps and opportunities in underperforming international markets and is a condition we evaluate in portfolio construction.

Presidential Election

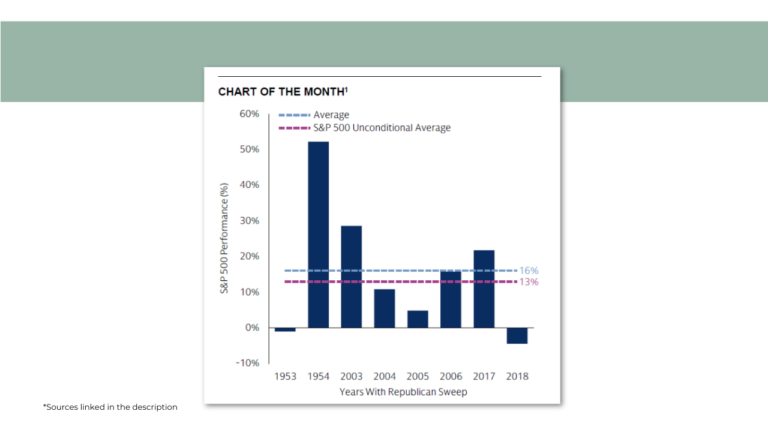

The U.S. presidential election was a pivotal event in the quarter. In the weeks leading up to the election, it appeared to be close. In the end, however, the result was decisive and markets reacted to the election results with optimism as investors weighed the potential implications of policy shifts under the incoming Trump administration. Key areas of focus included tax reforms, tariffs, deficit spending, changes to infrastructure investment, and regulatory adjustments. These outcomes will likely shape market dynamics across various sectors in the years ahead and historical data shows that periods of Republican control have often been associated with deregulation and infrastructure spending—factors that could further buoy equity markets.

As usual, geopolitical events added complexity to the investment landscape. Ongoing conflicts in Eastern Europe and the Middle East heightened demand for safe-haven assets like gold and U.S. Treasuries. Gold prices, which rose 27.5% for the year, were down slightly during the fourth quarter. The U.S. dollar had its best year in a decade, ending the year better by more than 7%. For investors, these developments underscore the importance of maintaining a balanced and diversified portfolio.

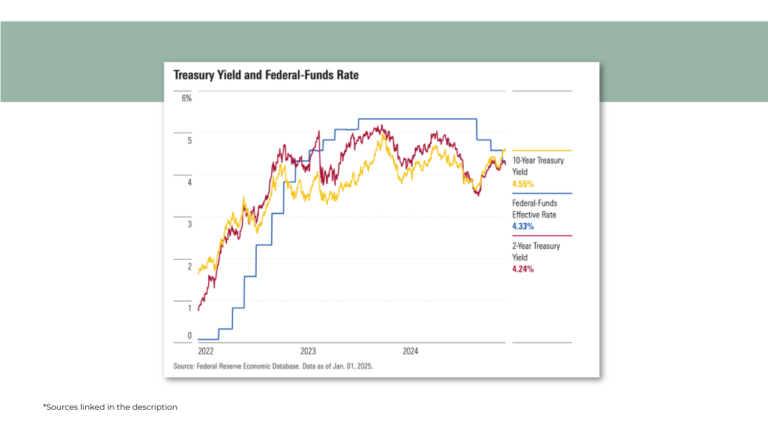

Inflation, Treasury & Federal Fund Rate

Longer-term interest rates remained elevated due to lingering concerns about our national debt and a lack of demonstrated fiscal discipline. Interest payments on the national debt now account for 13% of government spending, roughly on par with national defense expenditures. This sobering figure and higher rates despite Fed cuts underscore the long-term challenges of managing fiscal policy in an era of rising obligations. Even amid these pressures, bonds remain an essential tool for stability, and we’re actively monitoring the credit and duration risk in portfolios.

International Markets

China, grappling with modest growth, introduced a series of economic stimulus measures to revive its economy, the world’s second-largest. Policies such as property purchase incentives and reduced borrowing costs spurred renewed interest in emerging markets. Investors briefly responded favorably, driving gains in Chinese equities and improving sentiment across broader emerging markets. The China excitement was short-lived, but authorities there continue to look for ways to accelerate economic growth. Prevailing valuations present potential opportunities in China, even as structural challenges persist.

Energy markets experienced significant volatility during the quarter, with oil prices fluctuating in response to geopolitical tensions and shifting global demand. Natural gas, though, had a very strong year, gaining nearly 45%. While price swings presented challenges, they also emphasized the importance of diversification within energy portfolios. Select opportunities also emerged in infrastructure investments, which are positioned for long-term growth as the global energy transition continues and energy-intensive AI demand accelerates. Notably, utilities ended up 19.6% for year after giving back gains (down 7%) in the fourth quarter.

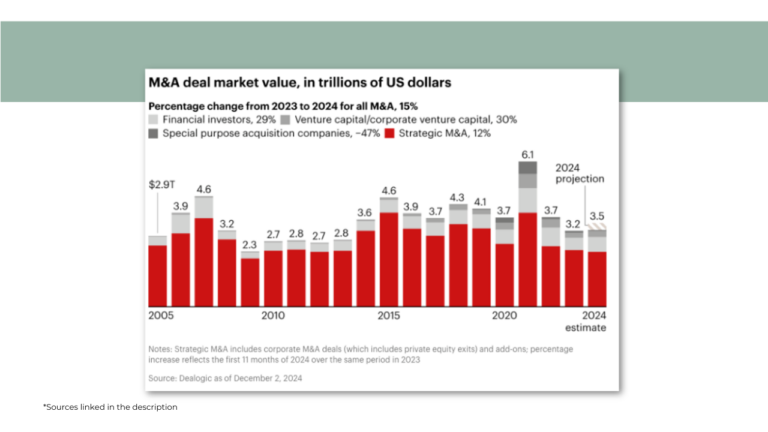

Corporate activity was another bright spot. Mergers and acquisitions grew as businesses sought to capitalize on strategic opportunities in a more stable economic environment. Meanwhile, the initial public offering (IPO) market showed signs of recovery, with several successful high-profile offerings. These developments underscored growing confidence among corporate leaders and investors alike, a positive sign for the broader economy. EY sees a 10% increase in M&A activity for 2025, following a 13% rise in 2024. Still, we’ve yet to eclipse pre-2020 levels.

Bitcoin

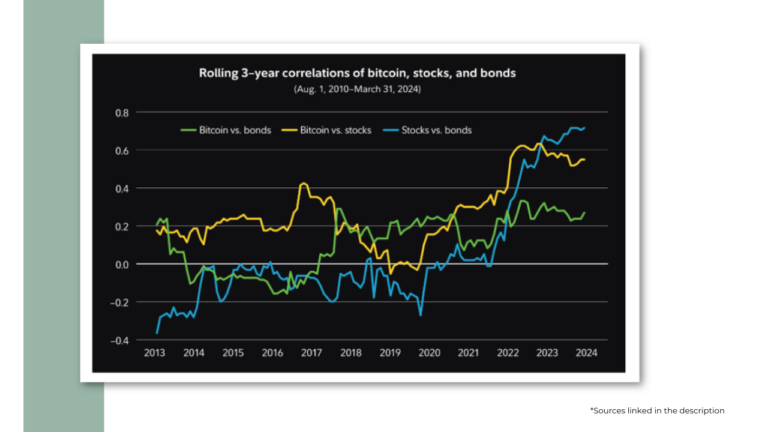

Bitcoin had a standout year, reaching the psychologically significant $100,000 milestone as it gained 52% for the quarter and nearly 120% for the year. Interest from institutional investors and exchange-traded fund (ETF) flows drove much of this surge. ETFs containing Bitcoin were approved in January; from a standing start, 12 funds held nearly $110 billion in assets by year-end. Increased adoption of blockchain technologies, combined with speculation about future regulatory clarity, supported Bitcoin’s role as both a mainstream speculative asset and a potential inflation hedge. While its volatility and rising correlations to traditional risk assets remain a notable concern, Bitcoin’s growing integration into traditional financial systems offers new opportunities for risk-tolerant investors seeking uncorrelated assets. As of the fourth quarter, we’ve added Bitcoin exposure to select portfolios.

Economy

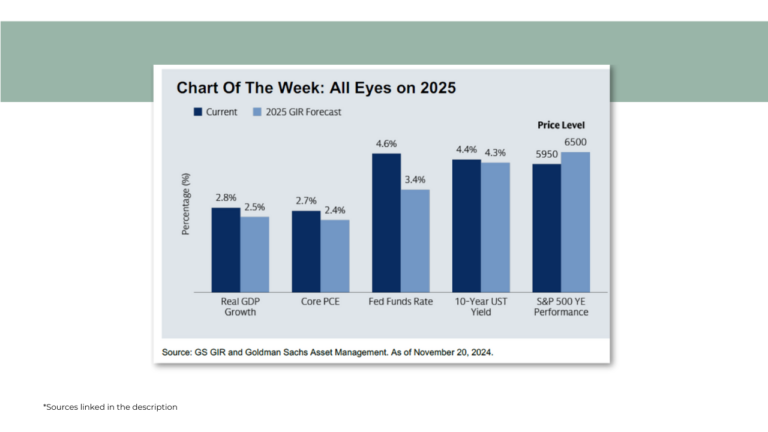

Looking Ahead: 2025 On the economic front, inflation moderated though not yet to the Fed’s 2% target by December, fostering optimism about the economic outlook but skepticism as to whether further cuts are in the cards. Unemployment remained low, and consumer spending during the holiday season exceeded expectations. These factors have showed the resilience of the U.S. economy and the continued strength of consumer demand, which represents nearly 70% of economic activity.

After reducing stock allocations in Diversidex portfolios during the fourth quarter, we have returned to our target exposure. Although our “Flex” models were close to being triggered, they remained in the market throughout the quarter. In our Essential portfolios, we increased exposure to the US by 2%, reduced small and mid-cap exposure by approximately 4%, and added 2% to technology.

Looking Ahead: 2025

As we begin 2025, the themes of cautious optimism and strategic adaptability remain central. Given the strong returns of recent years and current valuation levels, we see future equity returns as likely to be more muted than in the recent past. The S&P 500 Index ended the year over 25 times current earnings, up from below 22 at the same time last year. Over time, stock market returns come from two primary sources: earnings growth and changes in earnings multiples. While we see earnings continuing to expand, given the current level of and likely future trajectory for interest rates, we’d take the “under” for more earnings multiple expansion.

The fourth quarter’s developments highlighted the enduring value of diversification and a forward-looking perspective. While opportunities remain in the US and in technology in particular, international markets, smaller companies and “value” stocks present an interesting consideration set for portfolio allocations in an increasingly complex global environment.

As Warren Buffett said, “In the business world, the rearview mirror is always clearer than the windshield.” We are committed to helping you navigate these dynamics with confidence. As always, please reach out with any questions or to discuss adjustments to your portfolio.

Sources

Dollar: https://www.spglobal.com/spdji/en/indices/other-strategies/sp-us-dollar-futures-index/#overview

Bonds: https://www.spglobal.com/spdji/en/indices/fixed-income/sp-us-aggregate-bond-index/#overview

Utilities: https://www.spglobal.com/spdji/en/indices/equity/dow-jones-utility-average/#overview

High Yield: https://www.spglobal.com/spdji/en/indices/fixed-income/sp-us-high-yield-corporate-bond-index/#overview

Bitcoin ETFs: https://www.bloomberg.com/news/articles/2024-12-30/blackrock-s-bitcoin-fund-became-greatest-launch-in-etf-history

Top 10 Concentration: https://am.jpmorgan.com/se/en/asset-management/per/insights/market-insights/investment-outlook/ai-investment/

AI investments: https://www.goldmansachs.com/insights/top-of-mind/gen-ai-too-much-spend-too-little-benefit

Crypto market: https://coinbase.bynder.com/m/18348e25ea106276/original/Coinbase_Institutional_Crypto-Market-Outlook_2025_v1.pdf

Market summary: https://www.morningstar.com/markets/13-charts-q4s-big-post-election-rallyand-late-stumble#commodity-market-performance

Market assumptions / projections: https://www.blackrock.com/institutions/en-us/insights/charts/capital-market-assumptions

(As an aside: Bitcoin’s performance this past year was eye-popping, another commodity – cocoa – did even better: up an incredible 178%.)

Have you tuned in to our weekly video podcast, Blue Collar Wealth Presented by Stone House®?

Previous Video Market Updates

*These videos reflect the trends and worldly events taking place at the time of filming.*

Quarter 4, 2024

Quarter 3, 2024

Quarter 2, 2024

Quarter 1, 2024

Quarter 4, 2023

Quarter 3, 2023

Quarter 2, 2023

Quarter 4, 2022

Quarter 3, 2022

Quarter 2, 2022

Quarter 1, 2022

Quarter 4, 2021

Quarter 3, 2021

Meet the Stone House Team

Decades of combined experience in helping people enjoy retirement and reach financial freedom.

Robert J. Brown, CFP®

Partner

Raymond "Scott" Stone

Partner

John Burke

Partner

Kirk Lunger

Partner

Sayer Martin, CFA

Chief Investment Officer

Christine Slusark

Financial Paraplanner

Sherri Roberts

Financial Paraplanner

Barbara Grimaud, Esq.

Senior Advisor

Chad Taake, CFP®

Senior Advisor

Ben Robinson

Lead Advisor

Ryan Vassil, WMS℠

Lead Advisor

Mike Cravath, WMS℠

Lead Advisor

Larry Alderson, CFP®

Senior Advisor

Jennifer Schultz

Client Relationship Manager

Lori Brown

Client Relationship Manager

Katie Johnston

Lead Advisor

Stacey Valent

Office Manager

Lindsey Chiarelli

Director of Marketing & Operations

Anna Layaou

Marketing Content Manager

Leanne Kulah

Senior Client Service Specialist